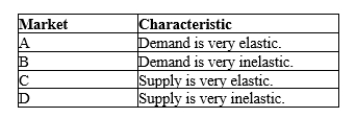

Table 8-1

-Refer to Table 8-1. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will maximize the deadweight loss(es) from the tax?

Definitions:

Finished Goods

Products that have completed the manufacturing process but have not yet been sold to customers.

Finished Goods Account

An account representing the total value of all completed products available for sale at the end of an accounting period.

Factory Overhead Ledger

A specific ledger that tracks all indirect costs associated with manufacturing operations, such as utilities, rent, and maintenance expenses for factory equipment.

Job Order Costing

A cost accounting system that accumulates costs according to individual jobs or orders, suitable for customized orders.

Q21: After a certain nation changed its policy

Q51: Refer to Figure 8-22. Suppose the government

Q84: Which of the following is not correct?<br>A)

Q100: Refer to Figure 8-11. The price labeled

Q113: To measure the gains and losses from

Q127: The supply curve for whiskey is the

Q205: Refer to Figure 9-1. In the absence

Q286: Supply-side economics is a term associated with

Q397: Refer to Figure 8-5. After the tax

Q430: Refer to Figure 8-1. Suppose the government