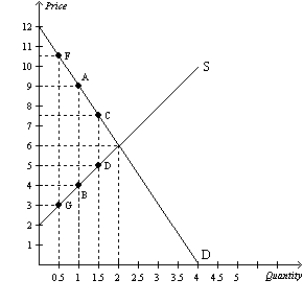

Figure 8-19

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-19.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

Definitions:

Segregation Of Duties

A risk management strategy where critical tasks are divided among different people to prevent fraud and errors.

Physical Controls

Security measures used to protect tangible assets, such as inventory and equipment, from theft, misuse, or damage.

Human Resource Controls

Systems and procedures put in place to regulate personnel activities and ensure compliance with organizational policies and laws.

Cash Receipts

Money received by a business or organization, typically documented during accounting periods.

Q44: Refer to Figure 8-5. The tax causes

Q50: Tom walks Bethany's dog once a day

Q141: The nation of Aquilonia has decided to

Q165: A tax is imposed on a certain

Q190: The world price of a ton of

Q201: The Laffer curve relates<br>A) the tax rate

Q437: Refer to Figure 9-14. When the country

Q438: The marginal tax rate on labor income

Q466: Assume, for Vietnam, that the domestic price

Q486: Refer to Figure 7-33. Suppose demand shifts