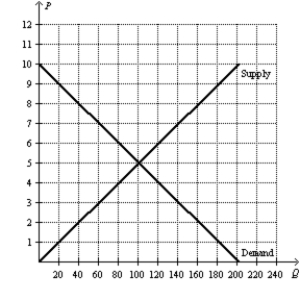

Figure 8-25

-Refer to Figure 8-25.Suppose the government places a $4 tax per unit on this good.How much is producer surplus after the tax is imposed?

Definitions:

Credit Terms

The conditions, including payment deadlines and interest rates, under which credit is extended to a borrower.

Aging Schedules

Timetables in accounting that categorize a company's accounts receivable according to the length of time an invoice has been outstanding.

Overdue Accounts

Financial accounts or receivables that have not been paid by the due date.

Receivables

Amounts owed to a company by its customers for goods or services provided on credit.

Q34: Refer to Figure 9-5. Bearing in mind

Q74: Refer to Figure 9-15. Producer surplus with

Q97: Refer to Figure 9-13. With trade, producer

Q124: To fully understand how taxes affect economic

Q166: Refer to Figure 7-34. Suppose there is

Q237: Refer to Figure 8-25. Suppose the government

Q296: Refer to Figure 8-24. Tax revenue would<br>A)

Q365: When a country allows trade and becomes

Q436: Suppose a tax of $4 per unit

Q486: Assume, for England, that the domestic price