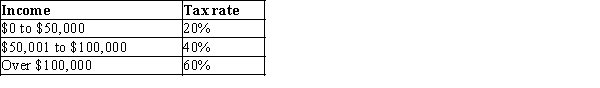

Table 12-5

-Refer to Table 12-5. What is the marginal tax rate for a person who makes $60,000?

Definitions:

Preferred Stock

A class of ownership in a corporation that has a higher claim on the assets and earnings than common stock, typically with fixed dividends and without voting rights.

Rate Of Interest

The percent of principal charged by the lender for the use of its money.

Future Value

The value of an investment at a specific date in the future, calculated by applying a rate of interest or return to the principal amount.

Annually

Occurring once every year or relating to a period of one year.

Q68: One economically efficient way to eliminate the

Q94: The U.S. income tax<br>A) discourages saving.<br>B) encourages

Q205: Costas faces a progressive federal income tax

Q222: State and local governments<br>A) are funded entirely

Q250: A common theme among examples of market

Q256: What are the three categories of the

Q294: For all types of goods that are

Q304: Refer to Scenario 13-11. An accountant would

Q424: The U.S. federal government collects taxes in

Q442: Refer to Table 12-9. Jake is a