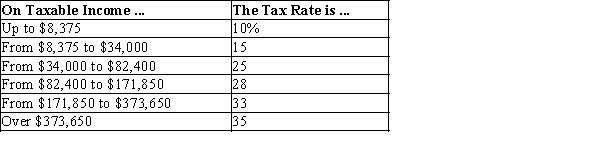

Table 12-10

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his marginal tax rate is

Definitions:

Leases

Contracts in which one party, the lessor, grants another party, the lessee, the right to use an asset for a specified period in return for regular payments.

Property

Legally recognized rights to possess, use, and dispose of something tangible or intangible.

Partnership

A legal arrangement where two or more individuals share the ownership, profits, and liabilities of a business.

Revised Uniform Partnership Act

The Revised Uniform Partnership Act provides an updated and standardized set of laws to govern the operation of partnerships within the jurisdictions that have adopted it.

Q89: Suppose the government taxes 25 percent of

Q129: Refer to Table 12-10. If Miss Kay

Q218: Most people agree that the tax system<br>A)

Q229: What do we mean when we say

Q232: Refer to Scenario 13-5. Emily's implicit cost

Q258: Which of the following statements is correct?<br>A)

Q380: If a firm uses labor to produce

Q384: Bev is opening her own court-reporting business.

Q451: Refer to Table 12-1. Assume that the

Q496: Refer to Table 12-6. For this tax