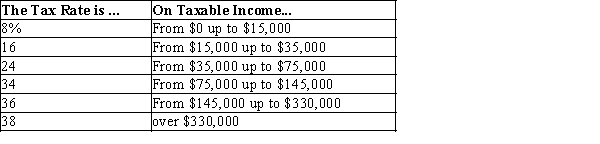

Table 12-11

-Refer to Table 12-11. If Al has taxable income of $165,000, his average tax rate is

Definitions:

Investing Activities

Transactions involving the purchase or sale of long-term assets and investments, as reported in a company's statement of cash flows.

Noncash Investing

Transactions that involve the acquisition or disposal of non-cash assets, such as property, plant, and equipment, through means other than cash payments.

Operating Activities

Activities directly related to the business's primary operations, such as manufacturing, distributing, marketing, and selling a product or service.

Gain

The profit realized from the sale of assets or investments when the selling price exceeds the purchase price.

Q84: Sales taxes generate nearly 50% of the

Q105: Which two types of goods are rival

Q109: A dairy produces and sells organic milk.

Q147: Refer to Figure 11-1. The box labeled

Q229: What do we mean when we say

Q363: Which of the following are taxed?<br>A) both

Q405: Part of the deadweight loss from taxing

Q418: What causes the Tragedy of the Commons?

Q529: European countries tend to rely on which

Q543: The three largest categories of spending by