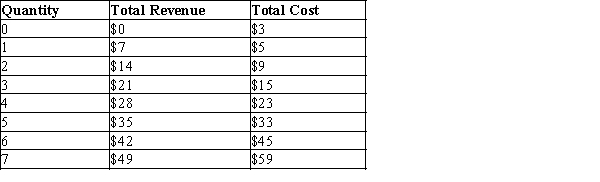

Table 14-10

Suppose that a firm in a competitive market faces the following revenues and costs:

-Refer to Table 14-10. The marginal cost of producing the 4th unit is

Definitions:

Modified AGI

An adjustment to Adjusted Gross Income (AGI) for specific items, affecting eligibility for certain tax benefits.

Qualified Expenses

These are specific expenses that meet criteria set by tax laws or other regulations for eligibility for tax benefits or deductions.

Finalized

To complete all required procedures to make a document or transaction officially valid and binding.

Child Tax Credit

A tax credit offered by the government which reduces tax liability for taxpayers with dependent children.

Q53: Refer to Scenario 14-1. At Q =

Q56: Consider a small hair styling salon. List

Q59: Refer to Table 14-4. For this firm,

Q83: Describe the relationship between average variable cost

Q116: Farmer McDonald sells wheat to a broker

Q138: Raiman's Shoe Repair produces custom-made shoes. When

Q162: Refer to Figure 14-7. Suppose AVC =

Q218: Refer to Figure 13-10. The firm experiences

Q282: In a perfectly competitive market, the process

Q604: Which of the following is an example