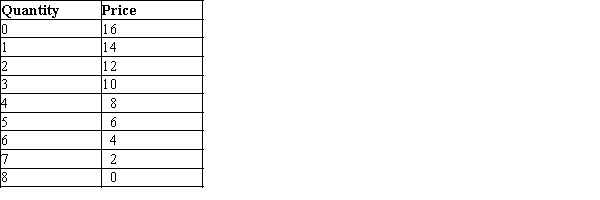

Table 17-9

The table shows the demand schedule for a particular product.

-Refer to Table 17-9. Suppose the market for this product is served by two firms that have formed a cartel. If the marginal cost of production is $0 and there is no fixed cost, the combined profit of the cartel will be

Definitions:

Reinvestment Risk

The risk that future cash flows from an investment will not be reinvested at the same rate as the initial investment, affecting the overall return.

Perfectly Negatively Correlated

A statistical measure indicating that two variables move in opposite directions to one another completely and consistently.

Global Minimum Variance Portfolio

A portfolio strategy that seeks to minimize the total variance of portfolio returns, focusing on the lowest possible risk for a given set of securities without targeting specific returns.

Expected Rate of Return

The average return anticipated on an investment, based on historical data or probabilistic models.

Q39: Consider monopoly, monopolistic competition, and perfect competition.

Q53: Refer to Figure 17-5. If the two

Q59: Discuss how brand names may enhance the

Q138: When deciding whether to hire an additional

Q219: The players in a two-person game are

Q237: In the case of oligopolistic markets, self-interest

Q309: A firm produces the welfare-maximizing level of

Q460: A tit-for-tat strategy, in a repeated game,

Q473: When a firm's demand curve is tangent

Q546: Which of the following is an example