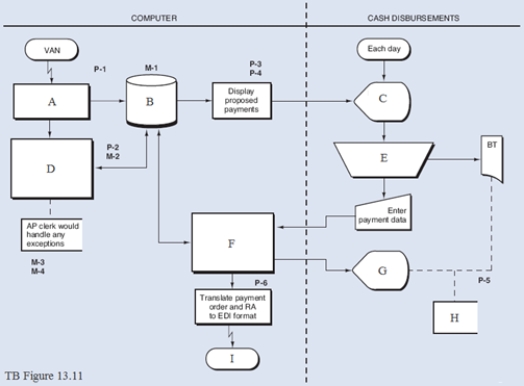

The flowchart below is the accounts payable/cash disbursements process presented in Chapter 13, but with certain items omitted. In the flowchart, each omission is indicated by a capital letter (A through I). Jumbled lists of the omitted items are as follows:

1. Compare incoming invaices to and recening report data and record AP and GL data

2. Display of proposed payments

3. Enterprise database

4. Exception rautine not shown

5. Paynent totals

6. Prepare payment order and RA, update AP and GL data far payment display payment tatals

7. Select payments, calculate batch totals

8. Translate fram EDI and record incaring invaices

9. VAN Required:

Complete the flowchart TB Figure 13.11 by placing one of the numbers, 1 through 9 from the above lists, to match the letters showing the missing items.

Definitions:

Schedule B

A form used with the IRS tax return to report interest and ordinary dividend income.

Interest Income

Earnings received from investments like savings accounts, CDs, or bonds.

Taxpayer

An individual or entity that is obligated to make payments to municipal or governmental authorities based on income earned or property owned.

Provisional Income

It's the total income a person has, including tax-exempt interest and half of their Social Security benefits, used to determine the taxability of Social Security benefits.

Q10: The B/AR/CR system supports the repetitive work

Q25: Factory workers record attendance and job time

Q26: The cost/benefit study attempts to answer the

Q28: A benchmark is a representative workload, processed

Q32: A disbursement voucher is designed to reflect

Q43: The managerial reporting officer is responsible for

Q68: The user, the programmer, and another member

Q102: The ACH network electronically transfers funds by

Q107: The credit department uses accounts receivable master

Q138: In a purchasing process, once requirements are