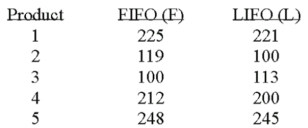

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Units Produced

The total number of units of product a company manufactures over a specific period of time.

Fixed Cost

Costs that do not vary with the volume of production or sales, such as rent, salaries, and insurance.

Relevant Activity Base

A factor that directly influences the costs incurred during a business activity, used for allocating costs in activity-based costing.

Decision-making Needs

The requirement for relevant, timely, and accurate information to make informed choices in business operations and strategies.

Q30: A company wants to estimate next years

Q38: If two dependent samples of size 20

Q44: For a two-tailed hypothesis test, the test

Q45: A manufacturer claims that less than 1%

Q81: For a sampling distribution of the

Q86: In multiple regression, what statistic summarizes the

Q92: The size of the sampling error is<br>A)

Q95: In an ANOVA table for a multiple

Q96: What does the t distribution approach as

Q103: When the null hypothesis for an ANOVA