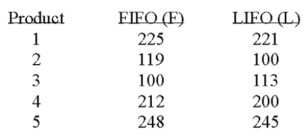

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  This example is what type of test?

This example is what type of test?

Definitions:

Dollars

A unit of currency used in the United States and other countries, symbolized by $.

Exchange Rate

The price of one country's currency expressed in another country's currency, facilitating international trade and finance.

Argentine Peso

The official currency of Argentina, utilized in financial transactions within the country.

American Truck

A vehicle designed and manufactured typically in the United States for the purpose of transporting goods and materials.

Q2: What are the inputs and the output

Q6: A sales manager for an advertising agency

Q16: Which of the following is a characteristic

Q21: If two independent samples of size 10

Q31: How is the significance level related to

Q49: A manufacturer of stereo equipment introduces new

Q51: The Intelligence Quotient (IQ) test scores are

Q74: The p-value is determined by the value

Q76: Manufacturers were subdivided into groups by volume

Q83: What is the null hypothesis for an