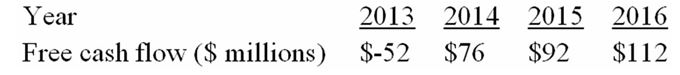

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air's equity per share at the end of 2012 under the following assumptions:

a.EBIT in year 2016 will be $200 million.

b.At year-end 2016,Kenmore Air has reached maturity,and analysts expect its equity will sell for 12 times year 2016 net income.

c.At year-end 2016,Kenmore Air has $250 million of interest-bearing liabilities outstanding at an average interest rate of 10 percent.

Definitions:

Financial Statements

Comprehensive reports created to present a business's financial performance and position, typically including the balance sheet, income statement, and cash flow statement.

Note Receivable

A formal agreement in which one party promises to pay another a specific sum of money, typically with interest, by a certain date.

Uncollectible Accounts

Accounts receivable that a business does not expect to collect due to customers' inability or unwillingness to pay, often leading to a write-off.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that guides the financial reporting for companies outside of the United States.

Q8: Honest Abe's is a chain of furniture

Q9: A closely held corporation is one that:<br>A)has

Q10: Which of the following statements best describes

Q13: When we make an estimate or prediction,

Q15: Assume a 365-day year for your calculations.The

Q18: Tasty Chicken Inc.has worked hard to develop

Q19: In a survey of employee satisfaction, 60%

Q24: The term "financial distress costs" includes which

Q32: If a management innovation is going to

Q71: The Equal Employment Opportunity Act requires employers