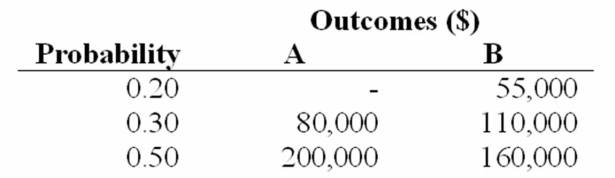

Investments A and B both cost $100,000 and each promises a single payoff in one year.The distribution of payoffs for each investment appears below.

Ignoring possible differences in nondiversifiable risk,which investment would a risk-averse investor prefer,and why?

Ignoring possible differences in nondiversifiable risk,which investment would a risk-averse investor prefer,and why?

Definitions:

Human Nature

The inherent characteristics, including ways of thinking, feeling, and acting, that all humans are believed to share.

Group Standard

A set of norms or expected behaviors shared by a group of individuals.

Cognitive Dissonance Theory

A theory suggesting that individuals experience psychological discomfort (dissonance) when holding two or more contradictory beliefs, ideas, or values.

Role-Playing Theory

The concept that individuals learn and understand roles by acting them out, which can influence their behavior and perceptions in various social contexts.

Q1: Quartiles divide a distribution into ten equal

Q4: Assume that in the years after 2015

Q8: Estimate the fair market value per share

Q14: You plan to buy a new Mercedes

Q22: Which one of the following is a

Q78: The value that occurs most often in

Q90: Quartiles divide a frequency distribution into _

Q91: Monthly commissions of first-year insurance brokers are

Q95: A company studied the commissions paid to

Q117: Refer to the following distribution of ages: