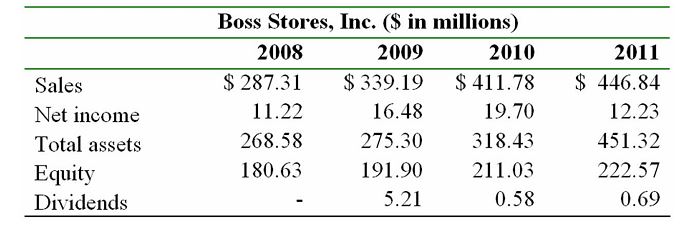

The following table presents financial information for Boss Stores, Inc., a retail chain store in the U.S.

-Use the information from Boss's annual financial statements.What is the actual sales growth rate for 2010?

Definitions:

Offered Rate

The rate of interest that a lender is willing to offer to a borrower for a specific loan, often influenced by market conditions.

Cost of Capital

The rate of return that a company must pay after accounting for the cost of all sources of financing: debt, equity, and any other financing sources.

Debt Costs

The total expenses associated with borrowing money, including interest payments and fees.

Financial Risk

The possibility of losing money on an investment or business venture, including the risk of not receiving anticipated returns.

Q1: What are the three issues related to

Q2: Please refer to Oscar's financial statements.All of

Q2: Which of the following is NOT a

Q9: What type of variable is the number

Q15: Incentive problems in a business can lead

Q15: The text makes it clear that the

Q21: The Limited collects 25 percent of sales

Q21: The retention ratio is:<br>A) equal to net

Q22: Which one of the following is a

Q30: According to Kantian theory on ethics:<br>A)an act