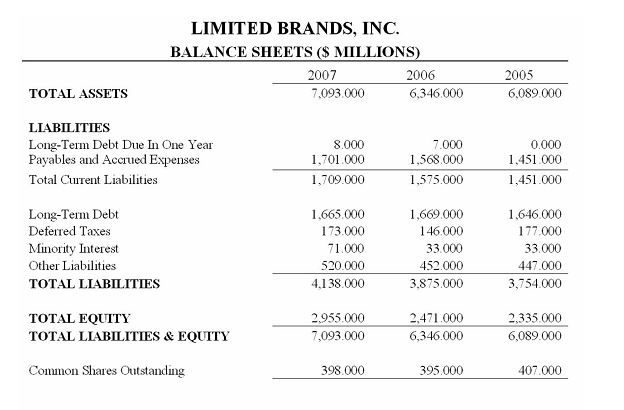

The financial statements for Limited Brands, Inc. follow (fiscal years ending January):

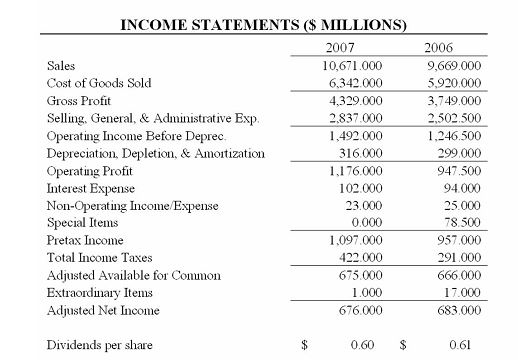

-Use Limited Brands,Inc.'s financial statements,above,to answer the following question.Use the company's operating profit as an approximation of its EBIT,and assume a 40% tax rate for your calculations.For the fiscal years ending in January of 2006 and 2007,calculate:

a)Limited Brands' total liabilities-to-equity ratio;

b)Times interest earned ratio; and

c)Times burden covered.

Definitions:

Accounts Payable

The amounts a company owes to its suppliers or vendors for goods or services received but not yet paid for; a liability on the balance sheet.

Collections Float

Float created while funds from customers’ cheques are being deposited and cleared through the cheque collection process.

Disbursement Float

Float created before cheques written by a firm have cleared and been deducted from the firm’s account. Disbursement float causes the firm’s own cheque-book balance to be smaller than the balance on the bank’s records.

Net Float

The difference between a firm’s disbursement float and collections float.

Q4: What roles do human capital and compensating

Q5: The number of students at a local

Q6: Many codes of ethics attempt to alter

Q35: The CEO of a company repeatedly highlighted

Q43: Decision control is made up of:<br>A)initiation and

Q56: When computing a weighed mean, the denominator

Q57: The lowest level of measurement that has

Q78: The "highest" level of measurement is _.

Q98: Refer to the following breakdown of responses

Q113: Refer to the following ages (rounded to