Tax Fighters,Inc.,develops,markets,and sells software for tax preparation.Tax Fighters,Inc.sells IRS Tax Fighter,a software for completing federal income tax forms and Gopher Basher,a software for completing Minnesota state income tax forms.For simplicity,assume that all of the costs in this industry are the fixed costs of developing the software packages themselves.The marginal cost of producing another disk is approximately zero.

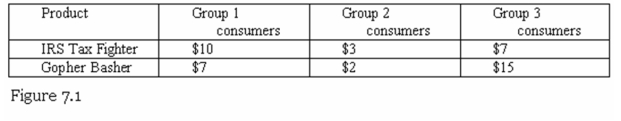

Consider the following information about the demand for tax software.There are an equal number of consumers in each group.Figure 7.1 shows the maximum that each type of consumer is willing to pay for each product.As vice president for pricing,explain your optimal bundling and pricing strategy to maximize Tax Fighter profits from the sale of tax software.Be sure to clearly explain why your strategy is.optimal.

Definitions:

Q12: There is scientific evidence to suggest that:<br>A)agents

Q20: Independent distributors of soda can free ride

Q20: Which of the following is a limitation

Q26: The issue with centralized versus decentralized decision

Q26: Assume MACROSOFT is planning to develop and

Q26: What are efficiency wages and why are

Q36: In a very basic principal-agent model,output is

Q38: The variety of communications channels for public

Q40: Business depends on the community for:<br>A) Education.<br>B)

Q52: Sexual harassment applies to:<br>A) Only men who