Tax Fighters,Inc.,develops,markets,and sells software for tax preparation.Tax Fighters,Inc.sells IRS Tax Fighter,a software for completing federal income tax forms and Gopher Basher,a software for completing Minnesota state income tax forms.For simplicity,assume that all of the costs in this industry are the fixed costs of developing the software packages themselves.The marginal cost of producing another disk is approximately zero.

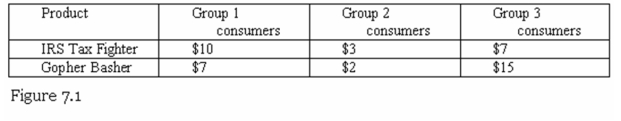

Consider the following information about the demand for tax software.There are an equal number of consumers in each group.Figure 7.1 shows the maximum that each type of consumer is willing to pay for each product.As vice president for pricing,explain your optimal bundling and pricing strategy to maximize Tax Fighter profits from the sale of tax software.Be sure to clearly explain why your strategy is.optimal.

Definitions:

Equity

The portion of a company's assets that belongs to the shareholders after debts and liabilities have been settled.

Non-Owner Sources

Non-Owner Sources refer to funds sourced from entities other than the owners, such as loans, creditor financing, or any external investments into the business.

Accounting Principle

Fundamental guidelines or rules that underpin the accounting practices and financial reporting standards.

Retained Earnings

The portion of net income that is not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt.

Q11: A working knowledge of both markets and

Q11: Which of the following is a primary

Q15: Which one of the following is implicit

Q15: The choice between specialized and broad task

Q18: If all issues of effort,output,and pay are

Q24: If a corporation operates two divisions that

Q24: Which of these statements is true regarding

Q30: What are the common transfer pricing methods?

Q36: Precontractual informational asymmetries that generate contracting costs

Q49: Recently released workplace statistics for high tech