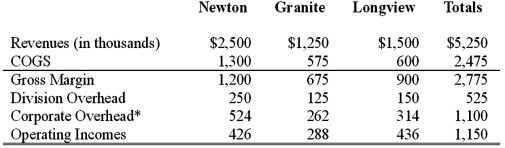

Performance of divisional managers at Leakproof Faucet Corporation is judged by an evaluation of the operating incomes of the divisions. Abbreviated income statements for the year ending 2013 are shown below for the three divisions of Leakproof Faucet Corp:

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

The manager of the Newton division, through increases in manufacturing efficiency, created some additional capacity in 2013. The only way he could have utilized this capacity would have been to manufacture a model J-5 faucet, which would have had the following impact on the Newton division:

Increase in annual revenues (in thousands) of $750.

Increase in cost of goods sold of $600.

Increase in divisional overhead of $100.

Mr. Garrett, the Newton division manager, chose not to manufacture the J-5 faucets; therefore, the additional capacity went unused.

Required:

(1) Prepare revised income statements for the three divisions for 2013 assuming that Mr. Garrett had chosen instead to utilize the additional capacity to manufacture the model J-5.

(2) Calculate the contribution margin of the Newton division if J-5 is manufactured and if it is not manufactured.

(3) Why did Mr. Garrett choose not to manufacture the J-5?

(4) Would Leakproof Faucets have benefited from the manufacture of the J-5?

(5) Identify an advantage and a disadvantage of not allocating any corporate overhead to the divisions.

Definitions:

Token Economies

A behavioral modification technique that uses tokens as a form of reinforcement for desired behaviors, which can later be exchanged for privileges or rewards.

Delusional Statements

Assertions that are firmly maintained despite being contradicted by what is generally accepted as reality.

Control Group

In experiments, a group of subjects that does not receive the experimental treatment and is used as a benchmark to measure the effects of that treatment.

Operant Conditioning

A learning process by which the strength of a behavior is modified by reinforcement or punishment.

Q19: A well-conceived strategic vision helps prepare a

Q27: Reasons for failure to implement the balanced

Q49: Costs such as depreciation, taxes and insurance

Q54: In service firms, improvement in long term

Q56: A competitive environment where there is strong

Q65: An engaging and convincing strategic vision:<br>A) ought

Q68: Identify and briefly describe the four most

Q71: Which of the following is true of

Q87: The evaluation by upper-level managers of the

Q114: The text presents what it calls a