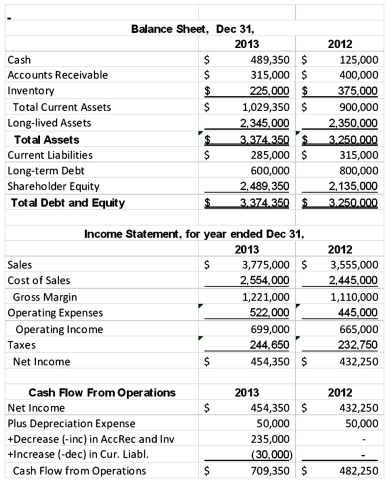

Jackson Manufacturing has the following operating results for 2013.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

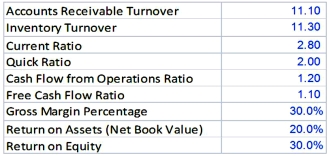

Exhibit A: Industry Ratios for the Jackson Company  Required:

Required:

1. Calculate the ratios In Exhibit A for Jackson Company for 2013, group them by category (liquidity, profitability) and develop a brief overview for the liquidity and profitability of the Jackson Company at the end of 2013.

2. Complete a Business Valuation for the Jackson Company based on 2013 financial statement information.

Definitions:

Viral Exposure

Contact with or introduction to a virus, which may lead to infection and illness.

Prenatal

Pertaining to the period or development before birth, encompassing the gestation period from conception to birth.

Prenatal Viral Exposure

Exposure to a virus in the womb during pregnancy, which can potentially lead to developmental disorders or health issues in the baby.

Schizophrenia

A serious psychological condition marked by disturbances in thinking, sensing, feeling, and relating to others.

Q11: A computer chip manufacturing giant decides to

Q38: A new entrant in a market dominated

Q67: Assigning a weight to each measure of

Q71: When companies engage in value-creating activities,they do

Q83: When an industry member is a major

Q90: Which of the following factors is NOT

Q94: The difference between a company's strategy and

Q95: To build a competitive advantage by out-managing

Q112: The primary limitation of using Economic Value

Q116: Strategic performance measurement is a(n):<br>A)Accounting system used