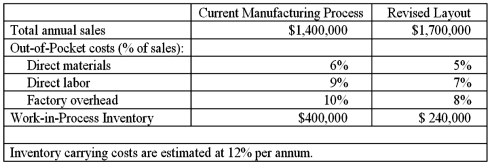

Turbo-Oven, Inc. is considering a move to cellular manufacturing. Management of the company has requested from you, as the management accountant, to supply it with information that will help inform the decision as to whether or not such a move is desirable. Your research into past performance of the company as well as extensive discussion with the manager of operations and the sales manager produced the following information.

Required:

Required:

1. In terms of the above information, provide for management of the company a rationale as to why you included each of the following items:

a. increase in total sales revenue

b. decrease in direct materials cost as a percentage of sales

c. decrease in holdings of Work-in-Process (WIP) inventory

2. Provide an estimate of each of the following financial effects associated with the proposed move to a cellular manufacturing layout:

a. change in total (out-of-pocket) manufacturing costs

b. reduction in WIP inventory holdings

c. net financial effect of the change, per year

3. In general, what types of costs would need to be incurred in order to reap the benefits outlined above in Requirement 2?

Definitions:

Angiotensin

A peptide hormone that causes vasoconstriction and an increase in blood pressure, also playing a role in the regulation of fluid and electrolyte balance.

Hypothalamus

A region of the brain below the thalamus that coordinates both the autonomic nervous system and the activity of the pituitary, controlling body temperature, thirst, hunger, and other homeostatic systems.

Hypovolemia

A medical condition characterized by a decrease in the volume of blood plasma in the body.

Diabetes Insipidus

A condition characterized by intense thirst and the excretion of large amounts of urine due to hormonal imbalances affecting water regulation in the body.

Q30: The market value of the company's equity

Q36: The difference between actual and standard cost

Q39: The book value of the company's equity

Q43: Performance shares grant stock for achieving certain

Q56: The value of the company, calculated using

Q59: The total standard direct labor cost for

Q67: The materials usage (quantity) variance for June

Q93: The Division A of Standard Products is

Q107: The difference between variable overhead cost incurred

Q144: What was Mandy's direct labor flexible-budget variance