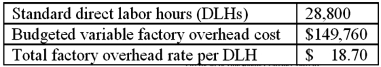

Redtop Co. uses a standard cost system and flexible budgets. The following flexible budget was prepared at the 80% operating level for the year:  However, for purposes of calculating the fixed overhead application rate, the company defined the denominator volume as the 90% capacity level. The standard calls for four DLHs per unit manufactured. During the year, Redtop worked 33,600 DLHs to manufacture 8,500 units. The actual factory overhead was $12,000 greater than the flexible-budget amount for the units produced, of which $5,000 was due to fixed factory overhead.

However, for purposes of calculating the fixed overhead application rate, the company defined the denominator volume as the 90% capacity level. The standard calls for four DLHs per unit manufactured. During the year, Redtop worked 33,600 DLHs to manufacture 8,500 units. The actual factory overhead was $12,000 greater than the flexible-budget amount for the units produced, of which $5,000 was due to fixed factory overhead.

Required: Calculate (and provide supporting details for) each of the following variances:

1. The standard variable overhead application rate.

2. The variable overhead efficiency variance.

3. The factory overhead spending variance.

4. The factory overhead production volume variance.

5. The variable overhead spending variance.

6. Provide an interpretation for each of the above variances you calculated

Definitions:

Third Estate

The common people of France under the ancien régime, distinct from the clergy (First Estate) and the nobility (Second Estate), who played a key role in the French Revolution.

Frankfurt Parliament

An assembly of German delegates from various states in 1848-1849, aiming to unify the German states and create a national constitution.

Taxpayer Money

Public funds generated from taxes imposed on individuals and businesses, used by governments for public expenditures.

State Rulers

Individuals who hold supreme authority and governance over a defined geographic territory and its population, often within a state or country.

Q20: Precision Instruments, Inc. is a national firm

Q31: What is the approximate internal rate of

Q50: Jordan Company manufactures doors and maintains a

Q57: The theory of constraints (TOC) approach is

Q62: A manufacturing company that uses standard costs

Q64: What price will the company charge if

Q104: The profitability index (PI) is calculated as:<br>A)Net

Q106: The following data of causes of absenteeism

Q132: Given this information, what is the indifference

Q151: McAllister Company's master budget for the year