You are provided with the following summary of overhead-related costs for the most recent accounting period for a company that uses a single overhead account, Factory Overhead, into which it records both actual and standard overhead costs during the period:

1. Overhead standard cost variances for the period:

a. Fixed overhead (FOH) spending variance = $1,600U

b. Production volume variance = $200F

c. Variable overhead (VOH) efficiency variance = $1,050U

d. Variable overhead (VOH) spending variance = $150U

2. Actual fixed overhead cost incurred (depreciation) = $15,800; actual variable overhead cost incurred (paid in cash) = $4,800

3. Standard overhead cost applied to production (i.e., WIP inventory) during the period = $18,000

4. Standard overhead cost of units transferred to Finished Goods Inventory = $20,000

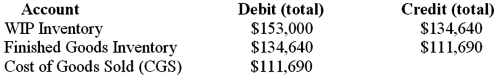

5. Before closing its accounts at the end of the period, the (standard cost) amounts affecting the inventory and CGS accounts is as follows:  Required: Prepare the proper journal entry for each of the following events:

Required: Prepare the proper journal entry for each of the following events:

1. Incurrence of actual FOH costs for the period.

2. Incurrence of actual VOH costs for the period.

3. Application of standard overhead costs to production (i.e., WIP inventory).

4. Recording of standard overhead costs for units completed during the period.

5. Recording of the four standard cost variances for the period.

6. Closing the standard cost variances under the assumption that the company closes these variances entirely to Cost of Goods Sold (CGS).

7. Closing the standard cost variances under the assumption that the company prorates the variances to the CGS and inventory accounts.

Definitions:

Customer Table

A structured format for organizing and storing information about customers in a database, often including fields like name, address, and purchase history.

Update Query

A command in SQL that allows modification of existing records in a database table.

Shortcut Menu

A context-sensitive menu that appears when a user right-clicks on an object, providing quick access to certain functions relevant to that object.

Action Query

In database management, it refers to a query (a request for data retrieval) that executes actions on the data such as inserting, updating, or deleting records.

Q8: What is the firm's total sales mix

Q26: The book (accounting) rate of return based

Q56: The actual direct labor rate per hour

Q77: The type of strategic business unit (SBU)

Q88: Reduced time-to-market, reduced expected service cost, and

Q94: What four variances may be included as

Q102: In a Cost of Quality (COQ) report,

Q105: In a discounted cash flow (DCF) analysis,

Q110: The total under or over applied overhead

Q130: What is ET's contribution margin sales volume