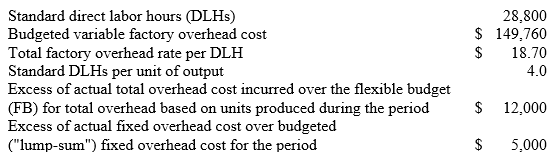

Redtop Co. uses a standard cost system and flexible budgets. The following flexible budget was prepared at the 80% operating level for the year: For purposes of calculating the standard fixed overhead application rate, the company defined the "denominator volume" as the 90% capacity level. As noted above, the standard calls for four DLHs per unit manufactured. During the year, Redtop worked 33,600 DLHs to manufacture 8,500 units. The actual factory overhead cost incurred was $12,000 greater than the flexible-budget amount for the units produced, of which $5,000 was due to fixed factory overhead.

For purposes of calculating the standard fixed overhead application rate, the company defined the "denominator volume" as the 90% capacity level. As noted above, the standard calls for four DLHs per unit manufactured. During the year, Redtop worked 33,600 DLHs to manufacture 8,500 units. The actual factory overhead cost incurred was $12,000 greater than the flexible-budget amount for the units produced, of which $5,000 was due to fixed factory overhead.

Required:

Calculate (and provide supporting details for) each of the following variances:

1. The standard variable overhead application rate (to two (2) decimal places) per DLH.

2. The variable overhead efficiency variance, to the nearest dollar.

3. The total factory overhead spending variance, to the nearest dollar.

4. The fixed overhead production-volume variance.

5. The variable overhead spending variance.

6. Provide a short description (i.e., interpretation) of each of the variances you calculated in requirements 2 through 5.

Definitions:

Individual's Expectations

This term describes the anticipations or beliefs about what will happen or what one will encounter in the future, specific to an individual.

Intelligence

Refers to the cognitive ability of a person to learn, understand, reason, make decisions, and adapt to new situations.

Central Nervous System

A network of nerve cells governing bodily functions, including the brain and spinal cord.

Sleep-Inducing

Sleep-inducing describes anything that causes or promotes sleep, such as certain medications, natural supplements, or environmental factors like darkness and quiet.

Q22: When a company uses absorption costing, there

Q22: In a joint production process, joint product

Q34: Design Products is committed to its quality

Q42: David Corporation manufactures a single product that

Q42: When the mix of products sold shifts

Q49: Costs such as depreciation, taxes and insurance

Q101: The weighted-average budgeted contribution margin per unit

Q111: The actual direct labor rate per hour

Q137: In framing the decision whether to investigate

Q167: The total overhead variance for the month