Required:

Required:

1. Calculate the current cost and profit per unit.

2. How much of the current cost per unit is attributable to non-value added activities?

3. Calculate the new target cost per unit for a sales price of $400 if the profit per unit is maintained.

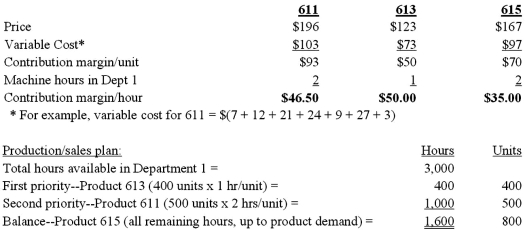

4. What strategy do you suggest for Warrenton to attain the target cost calculated in part (3)?Warrenton Industries manufactures hydraulic components for large automated machine tools. Myles English, the Vice President for Marketing, has concluded from his market analysis that sales are dwindling for one of the firm's products main products, a hydraulic valve, because of aggressive pricing by competitors. Warrenton's product sells for $525 whereas the competition's comparable part is selling in the $425 range. Mr. English has determined that a price drop to $400 is necessary to regain market share and annual sales of 1,000 units.

Cost data based on sales of 1,000 valves:

Definitions:

Family History

Information about diseases and health conditions that have occurred in a person's direct and close relatives, used for medical assessment and risk evaluation.

Breast Cancer

A malignant tumor that originates in the breast cells, one of the most common cancers among women.

Stage II

Typically refers to the level or extent of disease progression, often used in the classification of cancer or pressure ulcers, indicating localized spread or damage.

Lung Cancer

A type of cancer that begins in the lungs, often associated with smoking, characterized by the uncontrolled growth of abnormal cells.

Q23: "Firms need to use the capacity of

Q28: What is the annual book (accounting) rate

Q48: For product-costing purposes, which of the following

Q69: Special sales orders:<br>A)Are frequent.<br>B)Typically come directly from

Q78: The total variable cost flexible-budget variance for

Q117: Employee morale and social responsibility represent two

Q120: West Company budgeted the following credit sales

Q133: Within the context of capital budgeting, a

Q157: Under a three-way breakdown (decomposition) of the

Q164: Sensitivity analysis is used in capital budgeting