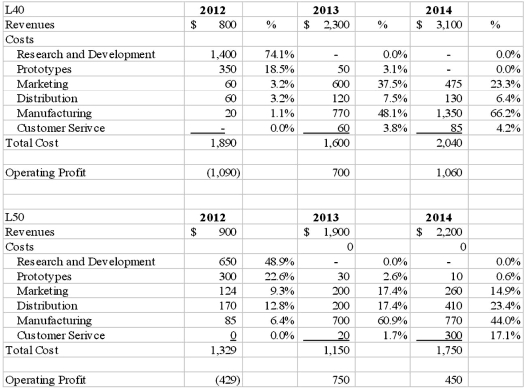

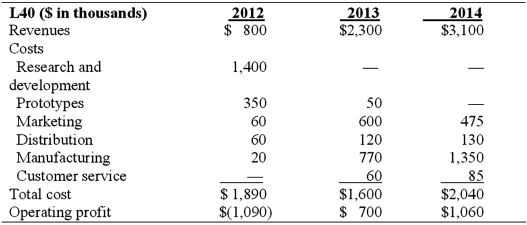

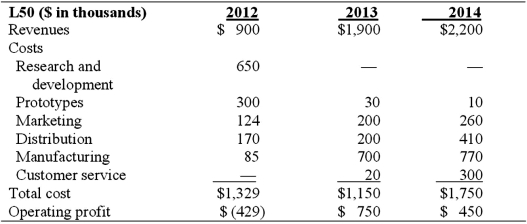

Life Cycle Costing Income Statements

Life Cycle Costing Income Statements

The following revenue and cost data are for Turner Manufacturing's two radial saws. The L40 is for the commercial market and the L50 is for industrial customers. Both products are expected to have three-year life cycles.

Required

Required

1. How would a product life-cycle income statement differ from the above income statements?

2. Prepare a three-year life-cycle income statement for both products. Which product appears to be more profitable and why?

3. Prepare a schedule showing each cost category as a percentage of total annual costs. What do you think this indicates about the profitability of each product over the three-year life cycle?

Definitions:

Q2: Which of the following is not an

Q4: Jamestown Furniture Co. is a small, but

Q27: Jared Monsma, Weekend Golfer's vice president for

Q38: The total amount of variable costs in

Q43: How many JM50 machines can Bryan Inc.

Q73: In a manufacturing environment the best short-term

Q73: The contribution income statement would require a

Q95: The factory overhead production volume variance is:<br>A)$600

Q100: The difference between budgeted fixed factory overhead

Q114: Three Stars Inc. manufactures prefabricated houses. The