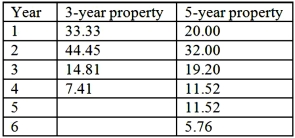

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's combined income tax rate is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below.  What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

Definitions:

Opportunity Cost

Represents the value of the best alternative that is forgone when a decision is made.

Unit(s)

The fundamental measurement or quantity of a good, service, or economic variable used as a standard or baseline for transactions, assessments, or calculations.

Toys

Objects designed for play or amusement, often targeted towards children.

Heckscher-Ohlin Model

A model in international trade theory that explains patterns of trade between countries based on their differences in factor endowments.

Q31: A comprehensive or overall formal plan for

Q49: Budgeted December cash payments by Yekstop Corp.

Q59: Which one of the following is the

Q63: Which of the following items has no

Q64: A budgeting system that has, in effect,

Q68: The profit margin based on manufacturing cost

Q69: The act of encouraging non-value-adding actions on

Q82: Which of the following is NOT a

Q91: Relevant costs for a make-or-buy decision for

Q132: Which one of the following is the