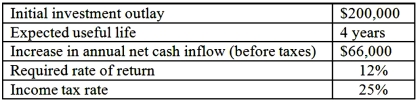

Harris Corporation provides the following data on a proposed capital project:  Harris uses straight-line depreciation method with no salvage value.

Harris uses straight-line depreciation method with no salvage value.

Required: Compute for this investment project:

1. NPV (the PV annuity factor for 12%, 4 years is 3.037)

2. IRR (to the nearest tenth of a percent). Note: PV annuity factors for 4 years: @ 8% = 3.312; @ 9% = 3.240; @ 10% = 3.170; @ 11% = 3.102; @ 12% = 3.037; and, @ 13% = 2.974)

3. Payback period (assume that cash inflows occur evenly throughout the year).

4. Accounting rate of return (ARR) on the net initial investment.

5. Discounted payback period (assume that the cash inflows occur evenly throughout the year; round your answer to 2 decimal places). The appropriate PV factors for 12% are as follows: year 1 = 0.893; year 2 = 0.797; year 3 = 0.712; year 4 = 0.636.

Definitions:

Behave Aggressively

Exhibiting actions or behaviors that intend to harm or intimidate others physically or psychologically.

Thirst Level

An individual's subjective feeling of needing to drink fluids, often influenced by physiological signals of dehydration.

Drive-Reduction Theory

A theory of motivation suggesting that the motivation arises from biological needs that demand satisfaction, driving individuals to reduce the state of tension through specific behaviors.

Motivated Behavior

Actions that are driven by internal or external forces aiming to satisfy specific needs or achieve particular goals.

Q5: The practice of maintaining budgets for the

Q23: "Firms need to use the capacity of

Q24: The annual breakeven point, in dollar sales,

Q35: Hightech Company recently developed the technology necessary

Q66: The overhead production volume variance for Megan,

Q68: All of the following capital budgeting models

Q97: The sales units required for Kelvin Co.

Q102: A truck, costing $25,000 and uninsured, was

Q120: Which of the following is different in

Q135: The Shoecraft Company's budgeted sales for January,