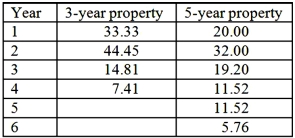

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine can produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's income tax rate is 40%. Management requires a minimum of 10% return on all investments. A partial MACRS depreciation table is reproduced below.  Required:

Required:

1. What is the payback period for the new machine (rounded to the nearest tenth of a year)? Assume for purposes of this calculation that the cash inflows occur evenly throughout the year.

2. What is the book (accounting) rate of return (rounded to the nearest whole percent) based on the initial investment and on average after-tax income over the five-year period?

3. What is the book (accounting) rate of return, based on the average investment, where the latter is determined as a simple average of beginning-of-project and end-of-project book value of the asset?

Definitions:

High Score

A measurement indicating a successful or above-average outcome in a test, game, or other assessment.

Discriminant Validity

A measure of validity based on showing that a test does not correlate too closely with other variables from which it is supposed to be distinct.

Social Desirability

The tendency of respondents to answer questions in a manner that will be viewed favorably by others, often leading to overreporting of 'good' behavior and underreporting of 'bad' behavior.

New Test

Refers to a recently developed method or instrument for assessment, evaluation, or measurement in various fields.

Q1: The Subway Sandwich Shop, Inc. is seeking

Q10: What was the actual hourly rate for

Q18: Which of the following five steps (out

Q18: What were the total standard hours allowed

Q21: Redtop Co. uses a standard cost system

Q26: This coefficient of determination explains that:<br>A)96% of

Q31: Based in Minneapolis, Minnesota, the Hubert Memorial

Q56: Gail Johnston is the CFO of Lancet

Q72: Amanda Jones owns and operates Motorcycle Rentals

Q87: Effective use of the CVP (cost-volume-profit) model