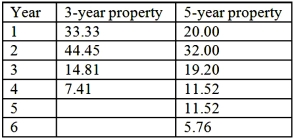

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine can produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's income tax rate is 40%. Management requires a minimum of 10% return on all investments. A partial MACRS depreciation table is reproduced below.  Required:

Required:

1. What is the estimated net present value of the investment (rounded to the nearest whole dollar)? (Note: PV $1 factors for 10% are as follows: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; the PV annuity factor for 10%, 5 years = 3.791.) Assume that all estimated cash flows occur at year-end.

2. What is the present value payback period (rounded to two decimal points)?

Definitions:

Z Scores

An index showing the variance of a specific value from the mean of a group, calculated through its number of standard deviations from the mean.

Probability

A measure of the likelihood that an event will occur, defined on a scale from 0 to 1.

Confidence

The degree to which one can be certain about the accuracy of a result, often quantified in statistics through a confidence interval.

Skewness

A measure of the asymmetry of the probability distribution of a real-valued random variable about its mean.

Q33: The objective function for the linear program

Q37: The authorization function of budgets is especially

Q37: The total direct labor flexible-budget variance in

Q38: A widely used approach that managers use

Q60: Bell Company produces and sells three products

Q92: Prokp's standard direct labor rate per hour

Q108: XYZ Corporation is contemplating the replacement of

Q130: What is the variable overhead (VOH) spending

Q141: Which of the following budgets is not

Q142: The estimated cash collection by Fresplanade Co.