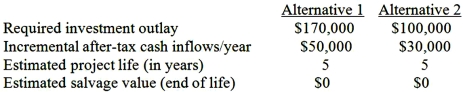

Slumber Company is considering two mutually exclusive investment alternatives. Its estimated weighted-average cost of capital, used as the discount rate for capital budgeting purposes, is 10%. Following is information regarding each of the two projects:  Required:

Required:

1. Compute the estimated net present value of each project and determine which alternative, based on NPV, is more desirable. (The PV annuity factor for 10%, 5 years, is 3.7908.)

2. Compute the profitability index (PI) for each alternative and state which alternative, based on PI, is more desirable.

3. Why do the project rankings differ under the two methods of analysis? Which alternative would you recommend, and why?

Definitions:

Self-Serving Ethical Principles

Moral rules or guidelines that individuals adopt, primarily to benefit themselves, often at the expense of others.

Distribution Of Power

The way power is allocated or spread among various parties or individuals within an organization, society, or group, affecting how decisions are made.

Effectiveness

The degree to which something is successful in producing a desired result; efficiency.

Tactics

Specific actions or strategies designed to achieve a short-term goal.

Q7: Which one of the following methods assumes

Q11: When there is a standard batch size

Q24: Winona Johnson is the president of Johnson

Q64: The objective of the fourth step in

Q76: Which of the following methods can be

Q87: The amount B is:<br>A)$100,300.<br>B)$102,000.<br>C)$103,440.<br>D)$105,600.

Q103: Product X's sales value at the split-off

Q126: Which one of the following is a

Q127: A plan showing the units of goods

Q154: In situations where a firm specifies different