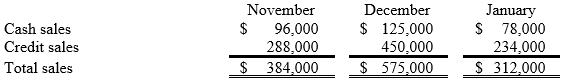

Information pertaining to Yekstop Corp.'s sales revenue is presented below: Management estimates that 4% of credit sales are eventually uncollectible. Of the collectible credit sales, 65% are likely to be collected in the month of sale and the remainder in the month following the month of sale. The company desires to begin each month with an inventory equal to 75% of the sales projected for the month. All purchases of inventory are on open account; 30% will be paid in the month of purchase, and the remainder paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling prices.

Management estimates that 4% of credit sales are eventually uncollectible. Of the collectible credit sales, 65% are likely to be collected in the month of sale and the remainder in the month following the month of sale. The company desires to begin each month with an inventory equal to 75% of the sales projected for the month. All purchases of inventory are on open account; 30% will be paid in the month of purchase, and the remainder paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling prices.

Total budgeted inventory purchases in November by Yekstop Corp. are:

Definitions:

Group Structure

The organization of a set of entities under common ownership or control, typically presented through a hierarchy that outlines the relationship between parent companies and subsidiaries.

Separate Financial Statements

Financial statements prepared for an individual company, as opposed to consolidated financial statements which combine the financials of the parent company and its subsidiaries.

AASB 139 Financial Instruments

A standard specifying the recognition and measurement of financial assets and financial liabilities.

Fair Value

The anticipated return from offloading an asset or the cost associated with handing off a liability, in a systematic engagement with market participants on the specified date of measurement.

Q13: Which method is (are) used to prepare

Q20: A plan that shows the cash balance

Q24: Cripe Corporation maintains ending inventory for each

Q30: Total equivalent units for Material P under

Q37: Motor Corp. manufactures machine parts for boat

Q51: The amount of joint costs allocated to

Q52: Total equivalent units for conversion under the

Q58: Which one of the following is true

Q96: How many units were started and completed

Q135: The Shoecraft Company's budgeted sales for January,