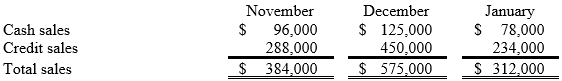

Information pertaining to Yekstop Corp.'s sales revenue is presented below: Management estimates that 4% of credit sales are eventually uncollectible. Of the collectible credit sales, 65% are likely to be collected in the month of sale and the remainder in the month following the month of sale. The company desires to begin each month with an inventory equal to 75% of the sales projected for the month. All purchases of inventory are on open account; 30% will be paid in the month of purchase, and the remainder paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling prices.

Management estimates that 4% of credit sales are eventually uncollectible. Of the collectible credit sales, 65% are likely to be collected in the month of sale and the remainder in the month following the month of sale. The company desires to begin each month with an inventory equal to 75% of the sales projected for the month. All purchases of inventory are on open account; 30% will be paid in the month of purchase, and the remainder paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling prices.

Total budgeted inventory purchases in December by Yekstop Corp. are:

Definitions:

Original Partners

The initial members who form a partnership by agreeing to share the responsibilities and profits of a business.

Information Tax Return

A type of tax document used to report various types of income, other than wages, salaries, and tips, to governmental tax agencies.

Accounting Entity

An economic unit with clearly defined boundaries for which financial transactions are recorded, separate from its owners or other business units.

Capital Credit

Refers to the allocation or distribution of a cooperative's net income back to its members based on their proportionate contribution or usage, often in the utility or service sector.

Q6: A "participative" budget is a(n):<br>A)Good two-way communication

Q18: What are the total conversion costs of

Q33: What is the net after-tax cash inflow

Q37: The authorization function of budgets is especially

Q52: Caldwell Company desires to enter a market

Q58: The annual breakeven point in unit sales

Q77: Generally, firms will price a product more

Q79: The Chapman Manufacturing Company has two service

Q130: Operating at or near full capacity will

Q151: When evaluating capital budgeting decision models, the