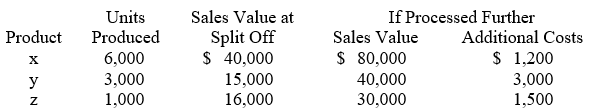

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow.  The amount of joint costs allocated to product X using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product X using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Diathermy

A type of heat therapy in which a machine produces high-frequency electromagnetic waves that achieve deep heat penetration in muscle tissue.

Rent Expense

The cost incurred by a business for the use of a property, facility, equipment, or other asset under a lease agreement, charged as an expense.

Prepaid Rent Expense

An expense account that records payments for rent made in advance of the rental period.

Adjusting Entry

At the end of an accounting timeframe, records are made to attribute income and spending to the specific period in which they were incurred.

Q11: Blake Company has $15,000 cash at the

Q17: Cost allocation of shared facilities cost is

Q17: Wild West Fashion expects the total costs

Q41: All of the following statements regarding activity-based

Q46: Which of the following industries is more

Q64: The ideal criterion for choosing an allocation

Q69: Which of the following is not a

Q74: The budget committee for Amacom Company, with

Q93: HJM Auto Parts makes a muffler/pipe assembly

Q128: What is the total manufacturing overhead assigned