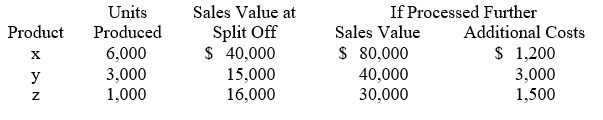

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Z using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Z using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Households

Entities consisting of one or more people living together who make joint decisions about consumption and finances.

Marginal Revenue

The additional income earned from selling one more unit of a good or service, crucial for decision-making in production levels.

Surround Sound Systems

Audio systems designed to immerse the listener in sound by using multiple speakers placed around the room to create a three-dimensional sound experience.

Total Revenue

The overall amount of money generated by a business from its sales activities before any costs or expenses are deducted.

Q13: Which of the following is not used

Q17: Cost allocation of shared facilities cost is

Q19: What should be the amount in the

Q52: If overhead is applied based on direct

Q58: The mixing constraint for the Keego linear

Q76: The total cost accumulated in the assembly

Q94: In making decisions about whether to sell

Q106: Using ABC, overhead cost assigned to Job

Q117: Customer profitability analysis:<br>A)Always shows that the company

Q122: Time-driven ABC provides a direct way to