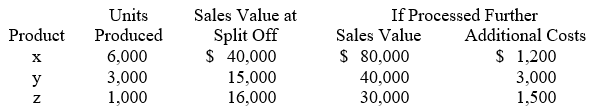

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Y using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Y using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Businesses

Organizations engaged in commercial, industrial, or professional activities with the aim of earning profits.

Chapter 7

A provision under the U.S. Bankruptcy Code dealing with the process of liquidation, where a debtor's assets are sold to pay creditors.

Meeting of Creditors

A gathering in bankruptcy proceedings where creditors can question the debtor about their finances and the bankruptcy petition.

Debtor's Assets

Property owned by an individual or entity that owes money to creditors, which can be used to pay off debts.

Q17: Cost allocation of shared facilities cost is

Q19: What should be the amount in the

Q44: Cost per equivalent unit for Material Q

Q47: What is the amount of direct materials

Q55: A decision bias is an inherent tendency

Q59: Place the six cost estimation steps into

Q61: Product costing provides useful cost information for

Q74: A retailer, in business for over 50

Q96: Omni, Inc. manages a medical-expense reimbursement program

Q116: The predetermined factory overhead rate is:<br>A)212% of