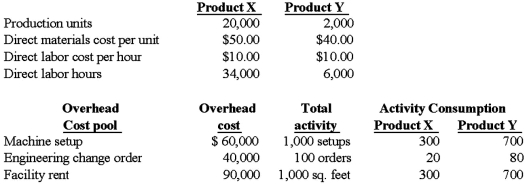

Altima Company uses an overhead costing system based on direct labor hours for its two products X and Y. The company is considering adopting an activity-based costing system, and collects the following information for the month of October.  Required:

Required:

(1) Compute the unit manufacturing cost of each product under a volume-based costing system based on direct labor hours.

(2) Compute the unit manufacturing cost of each product under the activity-based costing system.

Definitions:

Trademark

A recognizable sign, design, or expression that identifies and differentiates products or services of one trader from those of others.

Consumerism

The promotion of the consumer's interests, emphasizing the importance of consumption and acquisition of goods.

Trademark Infringement

The unauthorized use of a trademarked name or logo, which violates the rights of the trademark owner.

Lanham Act

A United States federal statute that governs trademarks, service marks, and unfair competition, providing protection to the owners of brands or logos used in commerce.

Q1: Many companies in the consumer products and

Q24: An R-squared value that approaches one (1.0)

Q26: Due in part to increased global competitiveness

Q38: If overhead is applied based on machine

Q53: Which of the following most accurately describes

Q74: A retailer, in business for over 50

Q85: Whittenberg Distributors, a major retailing and mail-order

Q95: Which one of the following methods of

Q97: The equivalent units for transferred-in costs under

Q102: Regression analysis is better than the high-low