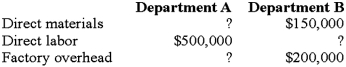

Harrison allocates factory overhead on the basis of direct labor cost. The overhead rates for the year are 50% for Department A and 100% for Department  The total manufacturing costs assigned to job M15 during May were $1,400,000.

The total manufacturing costs assigned to job M15 during May were $1,400,000.

Required:

Calculate the missing (?) costs (Department A direct materials and factory overhead and Department B direct labor).

Definitions:

Withholding Allowances

A number that employees claim on their W-4 form that reduces the amount of federal income tax withheld from their wages, based on their personal circumstances.

Form 4070

Form 4070 is a tax form used by employees to report tips to their employer, which are then subject to social security and Medicare taxes.

FICA Withholding

Taxes deducted from employees’ paychecks for Social Security and Medicare, based on the Federal Insurance Contributions Act.

Federal Income Tax

The tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q5: Selling and administrative expenses are calculated to

Q9: Which of the following is true regarding

Q13: Greenbelt Hospital has the following activities in

Q20: Which of the following,if any,will ABC Insurance

Q22: A local area consulting firm is trying

Q36: Distribution _ means distributing an estate by

Q51: Non-financial measures of operations include all the

Q56: If Orange, Inc. uses direct labor hours

Q58: An owner of a _ has a

Q92: The coefficient of determination for Armer's regression