Riverside Company manufactures two sizes of T-shirts, medium and large. Both sizes go through cutting, assembling and finishing departments. The company uses operation costing.

Riverside Company's conversion costs applied to products for the month of June were: Cutting Department $60,000, Assembling Department $60,000, and Finishing Department $30,000. June had no beginning or ending work-in-process inventory.

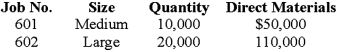

The quantities and direct materials costs for June follow:  Each T-shirt, regardless of size, required the same cutting, assembling and finishing operations.

Each T-shirt, regardless of size, required the same cutting, assembling and finishing operations.

Required:

(1) Compute both unit cost and total cost for each shirt size produced in June.

(2) Prepare journal entries to record direct materials and conversion costs incurred in the three departments, and the finished goods costs for both shirt sizes.

Definitions:

Investing Activities

Financial transactions and events related to the acquisition and disposal of long-term assets and investments, as reported in the cash flow statement.

Investing Activities

Financial actions related to acquiring or disposing of non-current assets, part of a company's cash flow statement.

Bonds Payable

A long-term liability account that represents the amount owed by an entity to bondholders, to be repaid at a future date.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use, reflecting its decrease in value over time.

Q10: Which of the following best describes the

Q20: Consider the following for Columbia Street Manufacturing:

Q29: Which of the following would originally have

Q33: Which of the following is false regarding

Q35: A document that outlines the principal-agent relationship

Q52: Since indirect cost cannot be conveniently or

Q58: Customer lifetime value is a type of

Q59: Wallace's only daughter,Bernice,married Donny,a young man that

Q60: In the landlord-tenant relationship,the party who assumes

Q114: The time ticket shows which amount for