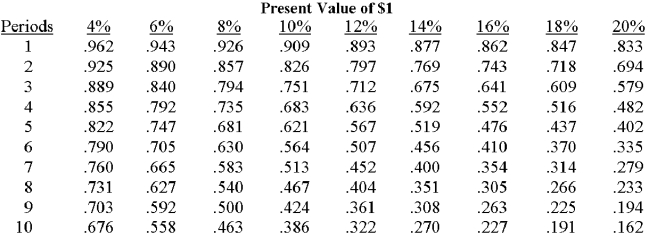

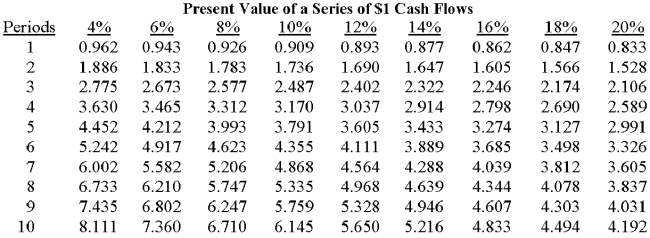

Reids Company,which uses net present value to analyze investments,requires a 10% minimum rate of return.A staff assistant recently calculated a $500,000 machine's net present value to be $86,400,excluding the impact of straight-line depreciation.If Reids ignores income taxes and the machine is expected to have a five-year service life,the correct net present value of the machine would be:

Definitions:

Creating Value

The process through which companies develop products, services, or processes that are valuable to customers, thus enhancing the company's profitability and market position.

Benefits

Advantages or positive outcomes that are provided by a product, service, or job, including tangible and intangible elements.

Needs and Wants

Fundamental human requirements (needs) and desires or wishes that are not essential but desired (wants).

Customer Value

The perception of what a product or service is worth to a customer versus the possible alternatives.

Q1: Today most firms are willing to pay

Q1: The number of secretaries is a basic

Q4: Capacity restrictions often change the way that

Q13: When companies reimburse their salespeople for expenses,these

Q20: Which of the following measures of performance

Q24: Westside Hospital has two service departments (Patient

Q27: Bath Works Company has $70,000 of depreciation

Q28: Tunley Corporation has excess capacity.If the firm

Q46: According to a recent survey,about _ of

Q83: Which of the following performance measures is