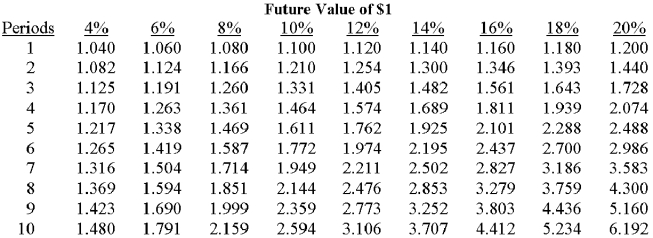

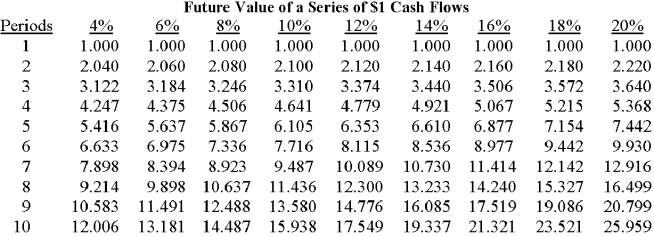

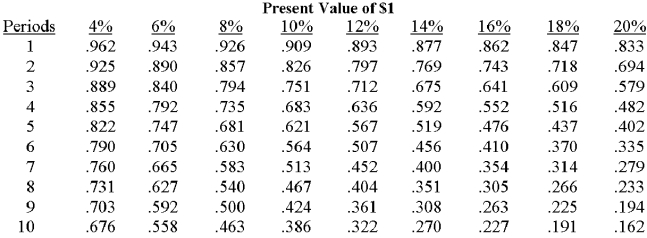

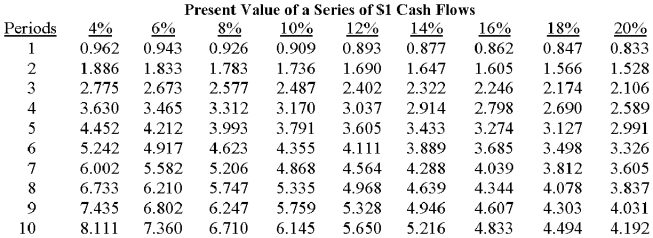

A new asset is expected to provide service over the next four years.It will cost $500,000,generates annual cash inflows of $150,000,and requires cash operating expenses of $30,000 each year.In addition,a $10,000 overhaul will be needed in year 3.If the company requires a 10% rate of return,the net present value of this machine would be:

Definitions:

Stock Price

The cost of purchasing a share of a company's stock, which fluctuates based on supply and demand in the marketplace.

Annual Dividend

The total amount of dividends a company pays out to its shareholders in one fiscal year.

Required Return

The minimum expected return by investors for investing in a non-risk-free asset, taking into account the risk associated with the investment.

Stock Payment

Compensation methods using shares of the company's stock, often employed in employee remuneration plans.

Q8: Assuming use of a responsibility accounting system,which

Q18: A piece of equipment costs $30,000,and is

Q32: Flowers Company is operating at capacity and

Q34: Which of the following measures would reflect

Q59: If Smythe follows proper managerial accounting practices,how

Q59: Trackings Corporation has two service departments (Maintenance

Q65: A division's return on investment may be

Q75: Suppose that one hog yields 250 pounds

Q79: Hightower Company plans to incur $350,000 of

Q86: Wardlaw Company,which experiences considerable seasonal variation in