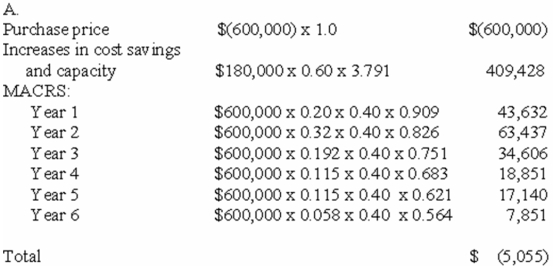

The Warren Machine Tool Company is considering the addition of a computerized lathe to its equipment inventory.The initial cost of the equipment is $600,000,and the lathe is expected to have a useful life of five years and no salvage value.The cost savings and increased capacity attributable to the machine are estimated to generate increases in the firm's annual cash inflows (before considering depreciation)of $180,000.The machine will be depreciated using MACRS for tax purposes.The 5-year MACRS depreciation percentages as computed by the IRS are: Year 1 = 20.00%;Year 2 = 32.00%;Year 3 = 19.20%;Year 4 = 11.52%;Year 5 = 11.52%;Year 6 = 5.76%.

Warren is currently in the 40% income tax bracket.A 10% after-tax rate of return is desired.

Required:

A.What is the net present value of the investment? Round to the nearest dollar.

B.No,the machine should not be acquired because it has a negative net present value.

B.Should the machine be acquired by the firm?

C.

The net present value will increase by $37,260.In this case,the machine should be acquired because it has a positive net present value.

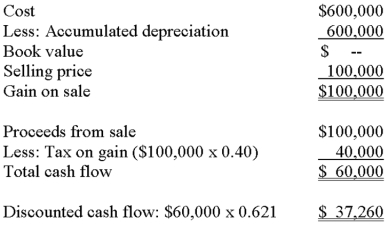

C.Assume that the equipment will be sold at the end of its useful life for $100,000.If the depreciation amounts are not revised,calculate the dollar impact of this change on the total net present valuE.

Definitions:

Gymnosperm Reproduction

The method of reproduction in seed-producing plants (gymnosperms) that do not form flowers, involving the release of pollen to fertilize ovules.

Pollen Grains

Microscopic structures produced by the male part of plants, containing male gametes, used for fertilizing the female ovules in the process of sexual reproduction.

Flagellated

Describing cells or organisms that possess one or more flagella, which are used for movement.

Asexually

Reproducing without the involvement of sex cells, resulting in offspring genetically identical to the parent.

Q10: Which of the following is not a

Q15: Sales Quotas are not typically related to

Q30: The number of female and minority salespeople

Q43: Which of the following types of sales

Q59: If Smythe follows proper managerial accounting practices,how

Q61: Reps are not supervised very closely,so they:<br>A)experience

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2489/.jpg" alt="

Q71: Excel Division reported a residual income of

Q75: Flexible budgets reflect a company's anticipated costs

Q100: Which of the following statements is true?<br>A)It