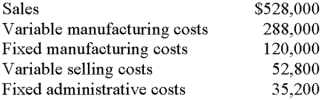

S'Round Sound,Inc.reported the following results from the sale of 24,000 units of IT-54:

Rhythm Company has offered to purchase 3,000 IT-54s at $16 each.Sound has available capacity,and the president is in favor of accepting the order.She feels it would be profitable because no variable selling costs will be incurred.The plant manager is opposed because the "full cost" of production is $17.Which of the following correctly notes the change in income if the special order is accepted?

Definitions:

Consolidated Financial Statements

Financial statements that present the assets and liabilities controlled by the parent company and the total revenues and expenses of the subsidiary companies.

Subsidiary Company

A company that is entirely or majority-owned by another company, referred to as the parent company.

Controlling Interest

Ownership of more than 50% of the common stock of another entity.

Short-Term Debt Investments

Investments made with the expectation of earning a return within a short period, typically less than one year, often in bond or money markets.

Q20: A number of antitrust laws have been

Q27: Lyman currently sells an industrial mixer for

Q31: The difference between the total actual factory

Q32: Seymore uses the step-down method of cost

Q36: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2489/.jpg" alt="

Q40: Howard Company has established the following standards:<br>Direct

Q46: Which of the following would not be

Q63: A flexible budget is appropriate for a(n):

Q65: Northwest's production data for one of its

Q84: Underwood Company uses cost-based transfer pricing.Its Food