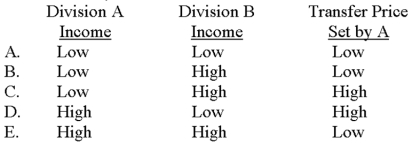

Division A transfers a profitable subassembly to Division B,where it is assembled into a final product.A is located in a European country that has a high tax rate;B is located in an Asian country that has a low tax rate.Ideally,(1) what type of before-tax income should each division report from the transfer and (2) what type of transfer price should Division A set for the subassembly?

Definitions:

Customer Objective

Customer objective involves defining what a business aims to achieve in relation to its customers, such as increasing customer satisfaction, loyalty, or retention rates.

Marketing Budget Allocations

The distribution of financial resources among various marketing activities or channels.

Past Sales

Past sales refer to the historical record of a product's or company's sales volume over a designated period, used for trend analysis, forecasting, and strategic planning.

Profits_

The financial gain realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

Q2: Sainte Claire Corporation has a highly automated

Q11: If Young operated at 35,000 hours,its total

Q12: The joint-cost allocation method that recognizes the

Q21: Heathrow employs cost-plus pricing formulas to derive

Q37: Draco's fixed-overhead budget variance is:<br>A)$6,000 unfavorable.<br>B)$7,000 unfavorable.<br>C)$10,000

Q44: Apex Metallurgy,Inc.has two service departments (Human Resources

Q49: Wilmar Corporation is budgeting its equipment needs

Q53: The new type of salesperson that has

Q58: In a cost-plus approach to pricing:<br>A)there is

Q82: Lawson,Inc.sells a single product for $12.Variable costs