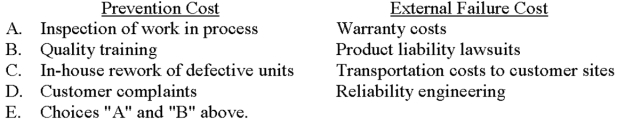

Which of the following choices correctly depicts a prevention cost and an external failure cost?

Definitions:

Diversifiable Risk

The risk associated with individual investments that can be reduced or eliminated through diversification across various assets.

Systematic Risk

The risk of loss associated with the entire market or market segment.

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates the stock is more volatile than the market.

Standard Deviation

A statistical measure that quantifies the amount of variation or dispersion of a set of values; widely used in finance to measure the volatility of an investment's returns.

Q4: A division's return on investment may be

Q9: Telfair & Company had 3,000 units in

Q9: Martin Company,which applies overhead to production on

Q12: The variable utilities cost per machine hour

Q37: If a company uses a cost-plus approach

Q43: DuChien Corporation recently produced and sold 100,000

Q46: Assume that machine hours is the cost

Q52: Product costs incurred after the split-off point

Q56: Refer to the figure above.The slope of

Q67: A direct-material quantity variance can be caused