Martin and Beasley,an accounting firm,provides consulting and tax planning services.For many years,the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable hours to clients.A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services,while 45% resulted from consulting services.

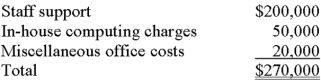

The firm,contemplating a change to activity-based costing,has identified three components of administrative cost,as follows:

A recent analysis of staff support found a strong correlation with the number of clients served.In contrast,in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions,respectively.Consulting clients served totaled 35% of the total client base,consumed 30% of the firm's computer hours,and accounted for 20% of the total client transactions.

If Martin and Beasley switched from its current accounting method to an activity-based costing system,the amount of administrative cost chargeable to consulting services would:

Definitions:

Income Tax Expense

The expense incurred by individuals or corporations due to taxable income, recognized in financial statements.

Corporation

A business organized as a separate legal entity under state corporation law, having ownership divided into transferable shares of stock.

Earnings Per Share

A financial metric that measures the portion of a company's profit allocated to each outstanding share of common stock, presenting a company's profitability.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing ownership value in the company.

Q6: Unused or excess capacity is a key

Q7: Most of the Sarbanes-Oxley Act relates primarily

Q8: When graphing the EOQ,which of the following

Q14: The contribution margin that the company would

Q33: Which of the following is a predetermined

Q49: Using the weighted-average method of process costing,the

Q59: Finney & Associates is an interior decorating

Q60: Which of the following is an example

Q74: EnviroSmart Chemical Company refines a variety of

Q84: Terry Pineno,new-accounts manager at East Bank of