Dancer Corporation,which uses a job-costing system,had two jobs in process at the start of 20x1: job no.59 ($95,000)and job no.60 ($39,500).The following information is available:

· The company applies manufacturing overhead on the basis of machine hours.Budgeted overhead and machine activity for the year were anticipated to be $720,000 and 20,000 hours,respectively.

· The company worked on three jobs during the first quarter.Direct materials used,direct labor incurred,and machine hours consumed were:

A.Determine the company's predetermined overhead application rate.

A.Predetermined overhead rate: $720,000 /20,000 hours = $36 per machine hour

B.

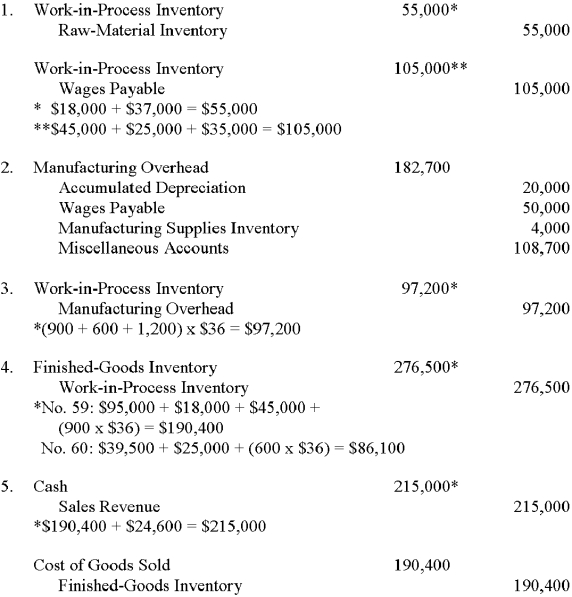

B.Prepare journal entries as of March 31 to record the following.(Note: Use summary entries where appropriate by combining individual job data. )

1.The issuance of direct material to production,and the direct labor incurreD.

2.The manufacturing overhead incurred during the quarter.

3.The application of manufacturing overhead to production.

4.The completion of job no.59 and no.60.

5.The sale of job no.59.

Definitions:

Payroll Tax

Charges applied to both employers and employees, often determined as a percentage of the wages paid to employees.

Per Unit

A term used to express costs, prices, or other measurements on an individual basis, allowing for straightforward comparisons or calculations.

Payroll Tax

Assessments collected from employers or employees, typically proportional to the salaries that workers are paid.

Labor Market

A marketplace where employers find workers and workers find jobs, involving the exchange of labor for compensation.

Q8: Edmonco's operating leverage factor was:<br>A)4.<br>B)5.<br>C)6.<br>D)7.<br>E)8.<br>

Q21: A manufacturing firm produces goods in accordance

Q24: Indirect costs:<br>A)can be traced to a cost

Q25: According to _,an employee may not be

Q29: Federal,state,and local government workers are excluded from

Q45: Public policy has focused on two types

Q53: The accounting records of Diego Company revealed

Q59: _ is a combination of strategies developed

Q59: Define the term "relevant range" and explain

Q61: The break-even point is that level of