Xi Manufacturing,which began operations on January 1 of the current year,produces an industrial scraper that sells for $325 per unit.Information related to the current year's activities follows.

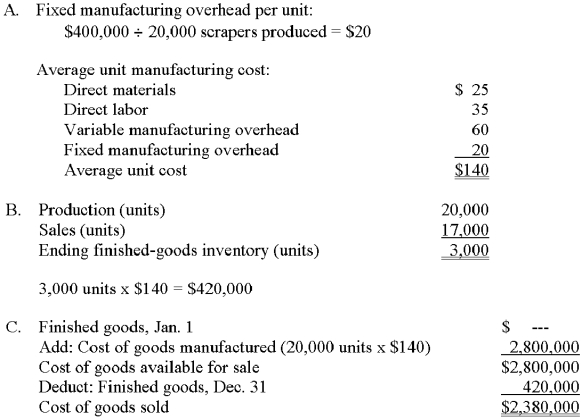

A.Compute the company's average unit cost of production.

B.Determine the cost of the December 31 finished-goods inventory.

C.Compute the company's cost of goods sold.

D.1.No change.Direct labor is a variable cost,and the cost per unit will remain constant.

2.No change.Despite the increase in the number of units produced,this is a fixed cost,which remains the same in total.

D.If next year's production increases to 23,000 units and general cost behavior patterns do not change,what is the likely effect on:

1.The direct-labor cost of $35 per unit? Why?

2.The fixed manufacturing overhead cost of $400,000? Why?

Definitions:

Commercial Unit

A term used in sales law referring to a standard or unit of goods that is regarded as a single whole for purposes of sale and division.

Accept Goods

The act of receiving or taking delivery of goods in a manner that conforms with the terms of a contract.

Nonconformity

A deviation or failure to meet specified standards, often relating to quality or performance in products or services.

Replace Defective

The process of substituting goods or services that are flawed or do not meet the contractual specifications.

Q1: _ use geo-diversity to great advantage,placing their

Q15: The term "normal costing" refers to the

Q28: Colonial Products employs a process-costing system for

Q32: The accounting records of Brownwood Company revealed

Q54: If the NLRB finds that either party

Q56: Much of managerial accounting information is based

Q60: If Kelly and Logan switched from its

Q60: Describe the five "core" characteristics of the

Q74: Fletcher,Inc.disposes of under- or overapplied overhead at

Q78: The role of the safety committee is