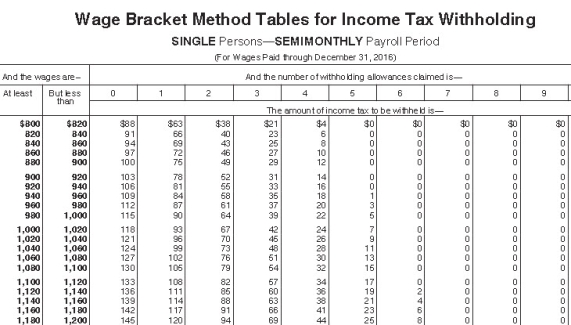

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k) plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table) ?

Definitions:

Self-Improvement

The pursuit of personal growth by improving one's abilities, knowledge, and qualities.

Grade Point Average

An educational scoring system that calculates the average of all grades obtained by a student, indicating their academic performance.

Break-Even Analysis

A financial calculation that determines the point at which revenue received equals the costs associated with receiving the revenue, thereby resulting in neither a profit nor a loss.

Contribution Margin

Contribution margin is a financial metric that represents the difference between a company's sales revenue and variable costs, used to assess the profitability of individual products or services.

Q7: State and Local Income Tax rates _.<br>A)

Q16: Andie earned $680.20 during the most recent

Q17: The growth rate of the world population

Q30: Federal income tax,Medicare tax,and Social Security tax

Q37: In a reverse annuity mortgage,a lender uses

Q42: Congress passed the _ and _ to

Q62: If you never married,you don't need to

Q105: Under certain circumstances,the Roth IRA allows for

Q134: Which type of will allows you to

Q136: The main advantage of the exemption trust