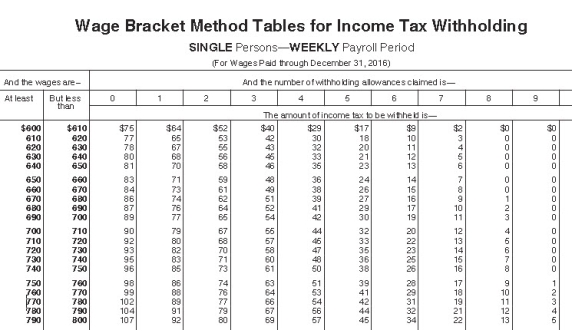

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table) ?

Definitions:

Sales Revenue

The overall amount of money a business earns through the sale of products or services, prior to deducting any costs.

Cash Account

An account that records all transactions involving cash inflows and outflows.

Bank Statement

A document provided by a bank, summarizing the transactions that occurred in an account over a period.

Accrual Accounting

An accounting method that records revenues and expenses when they are earned or incurred, regardless of when the cash transaction occurs.

Q13: Natalie is involuntarily terminated by a company

Q22: During his first month of employment,Alix took

Q23: The creeping movements along some segments of

Q33: The annual payroll tax guide that the

Q35: Wyatt is a full-time exempt music engineer

Q44: The fires from the 1906 San Francisco

Q45: The types of rock or sediment on

Q63: Lava domes form when high viscosity magma

Q76: The payroll register is a confidential company

Q80: Which of the following states has the