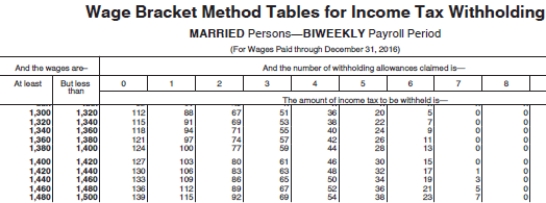

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points. )

Definitions:

Gen Ys

A demographic cohort, also known as Millennials, born approximately between the early 1980s and mid-1990s, notable for their familiarity with digital technology, media, and communications.

Work-Life Balance

The ability to effectively manage the demands of both one's professional and personal life without one negatively impacting the other.

Power Distance Cultures

Societies or cultures that accept and maintain differences in power and authority among their members.

Individualistic

Characterized by independence and self-reliance in thought and action, prioritizing personal goals over group goals.

Q6: When magma nears the surface,gases come out

Q9: In the _,Steno stated that in an

Q11: It is vital to engage in basic

Q11: The factors that determine an employee's federal

Q16: A disclaimer trust is designed for the

Q26: According to the Consumer Credit Protection Act,what

Q36: Why do employers use checks as an

Q51: As of 2010,what is the maximum yearly

Q79: The southernmost segment of the San Andreas

Q157: Social Security is a package of protection,providing